Opportunities for serious investors.

Discover new investment opportunities that have been vetted and cleared for growth.

Why You Need Tailwind

Access vetted investment opportunities.

We connect you with diligently prepared ventures — companies with the right evidence, the right story, and the strategic positioning to deliver returns.

Our clients have undergone rigorous diagnostic work, built compelling evidence, and crafted investment-grade stories.

The Result? Higher-quality opportunities with stronger fundamentals and better outcomes.

Tailwind offers investors:

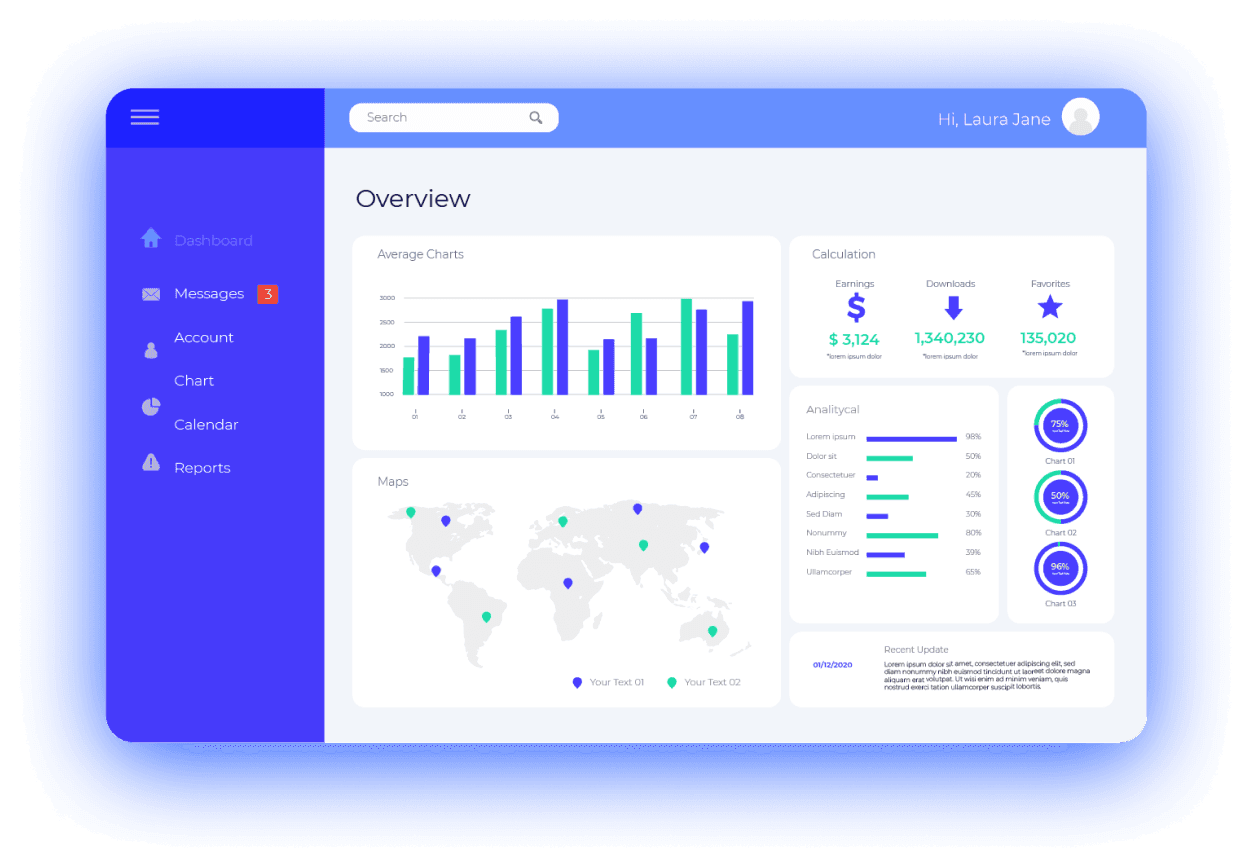

Deep due diligence

Our team conducts extensive due diligence on companies to accelerate the learning curve and present investment opportunities in a clear, concise manner.

Expanded horizons

We expand the breadth of high-graded investment opportunities, providing line-of-sight to companies that may not have come across your desk.

Curated opportunities

Subscribe and we’ll only share meaningful investment opportunities that fit your investment criteria, saving you valuable time.

Ability to get to yes (or no) faster

Our process is time-efficient, with significant due diligence done prior to the investor meeting the company, accelerating the investment decision-making process.

Save your time. Lower your risk.

Outsource your due diligence.

Tailwind is the gold standard for due diligence. Our expert team delivers in-depth evaluation and investment recommendations to enable decisions with conviction.

Tailwind conducts a rigorous qualitative and quantitative investigation of each investment opportunity. Our process is based on our best-in-class methodology, with extensive industry research, benchmarking, and analysis

WHY TAILWIND?

We do deep due diligence.

Review our curated ventures at a glance or in meticulous detail. Every PaperPlane Project has been diligently selected, mentored and scrutinized, taken apart and built back up to provide our investors the utmost confidence. We only back the top alumni from our FlightPlan™ curriculum — so if you see the PaperPlane Projects stamp, the venture is vetted, cleared and ready to scale.

AVIATOR NETWORK

Seasoned Aviators.

Our Aviator Program unites experienced entrepreneurs, executives, VCs, and Angel Investors with the next generation of founders. Aviators join to share their insights with ventures that align with their expertise and interests - helping emerging founders to navigate the highs and lows of venture building.

News & Views

Killing the Angel Investor

Since Tailwind commenced operations in the fall of 2018, we have met with hundreds of entrepreneurs, start-ups, and early-stage companies. These[...]

Read More

ClearSky Global raises US$168 Million to Deploy Low Carbon Alternative Fuels across Canada and North America

Tailwind Ventures Inc. acted as Financial Advisor on behalf of ClearSky Global Corp. ClearSky Global raises US$168 Million to deploy Low Carbon[...]

Read More

LPs are not happy — and for good reason.

LPs are not happy — and for good reason. In 2023, net cash flow to LPs was at a deficit of US$43 billion — the largest such annual deficit in US[...]

Read MoreFAQs for Investors

Investors likely see too much deal flow, constantly being bombarded by companies and pitch decks asking for investment. Only the rare, exceptional few, will be investment-ready and meet your investment criteria. It is difficult and time consuming to distinguish the investable companies from the rest. Tailwind's FlightPlan™ is a comprehensive due diligence program that thoroughly screens and readies companies for investment, prior to connecting with investors. We high-grade opportunities that meet your investment criteria, thereby saving you time.

We understand that you have a tried-and-true due diligence process. We aren't here to change that. FlightPlan™ is designed to augment and accelerate the process that you already use. Ideally, by the time that you dive into understanding a company introduced by Tailwind, most of your questions are answered, and you can focus your efforts on determining if a company is a fit within your portfolio.

Our FlightPlan™ program is all about risk mitigation and respect for capital providers. Getting it right is everything, getting it wrong is costly. We have a shared goal of safeguarding capital and generating above-average returns.

Prior to making an investment, investors use Tailwind as a trusted partner to provide an unbiased third-party perspective in the investment decision. Our incremental diligence and assessment of high-graded opportunities provides investors with additional assurance, prior to becoming fully invested in a new portfolio company.