LPs are not happy — here's how VCs are responding.

In our last blog, LPs are not happy — and for good reason, we discussed the ramifications of underperformance in the venture capital asset class.

To recap: LPs are not seeing returns on their capital, and consequently, there is less confidence and less money to reinvest into the asset class today — and the ventures of tomorrow have less access to capital to fund their innovation and growth.

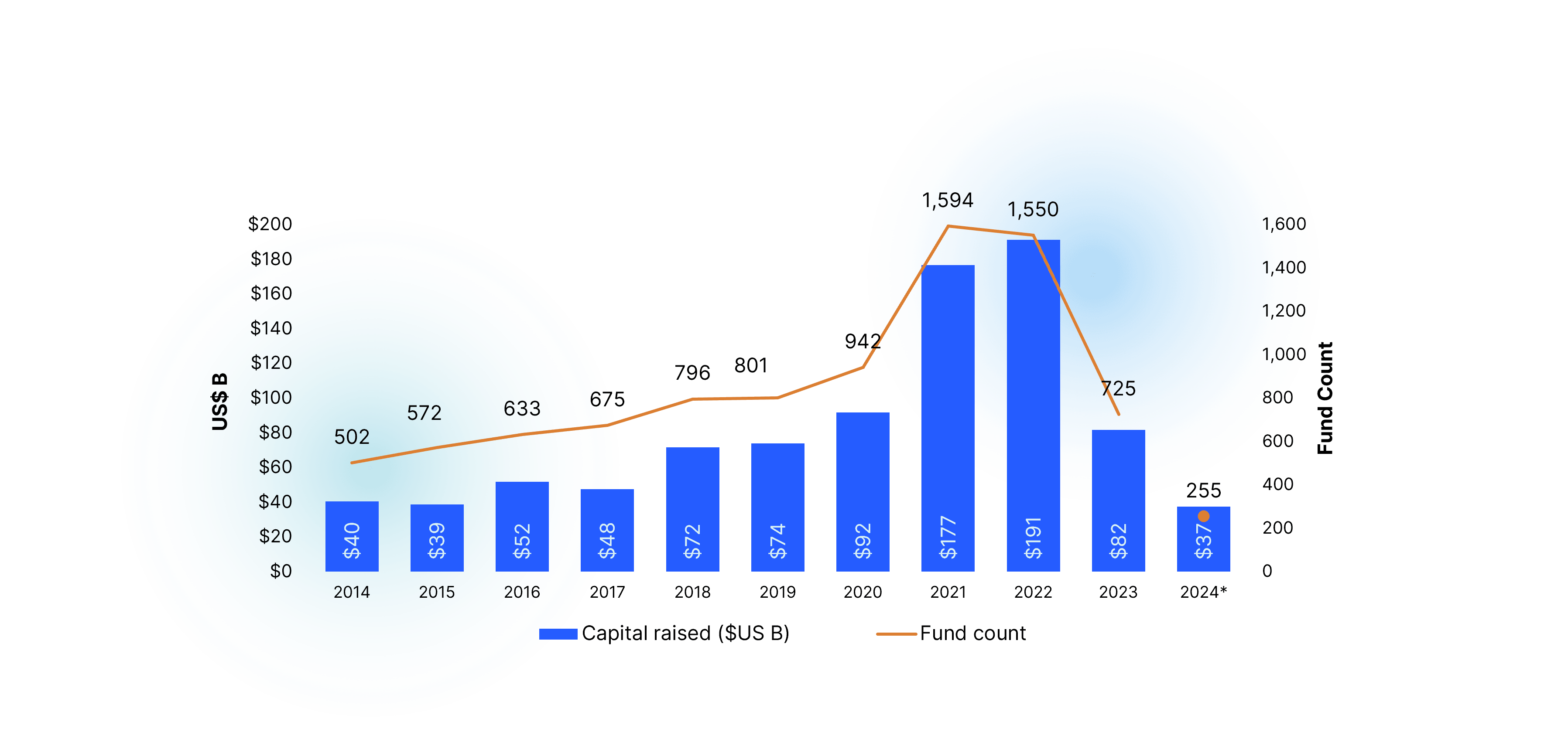

Today’s problems are reflected in the data visualization below, which illustrates that fewer venture funds are raising, and in aggregate, venture funds have been raising less capital to invest in the VC asset class.

Interestingly, average capital raised per fund has increased significantly to US$147 million per fund in H1 2024, which is at an all-time high versus the trailing 10-year average of US$93 million per fund.

This likely reflects survivorship bias — the few venture funds that were relatively successful are ‘living on’, and parlaying their relative success into raising larger funds than before.

VCs are becoming increasingly risk averse

In this increasingly competitive market for capital, VCs are becoming increasingly risk averse. VCs are on the clock to secure returns for their LPs, and ultimately provide themselves with the opportunity to survive and raise a subsequent fund.

We are witnessing two ways in which VCs are managing their risk exposure:

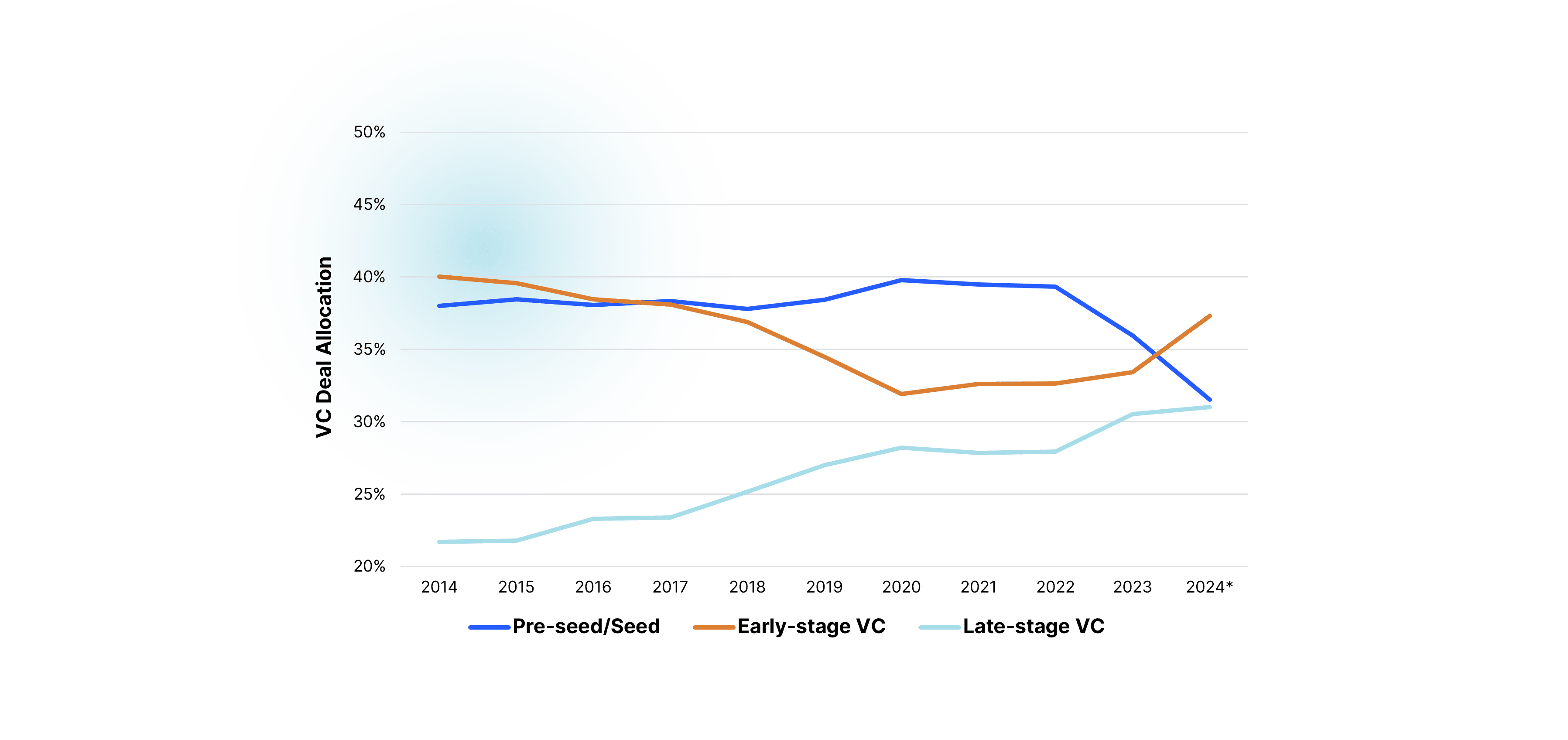

1. VCs are increasingly weighting their investment exposure to more mature ventures. VCs are moving up-market, targeting investments in ventures that have greater traction, and therefore, less risk. The bar to secure a VC’s investment has been raised.

2. When VCs are investing in pre-seed / seed or early-stage ventures, they are now doing so with larger cheque sizes, on average.

Over the past decade, pre-seed / seed average cheque sizes increased by 216% to US$3.3 million.

Early-stage average cheque sizes increased by 132% to US$12.3 million.

VCs opting to write fewer, but larger, cheques into earlier stage investments likely indicates that these ventures have distinctly matured (i.e., they are ‘safer bets’).

All else equal, larger cheques enable longer runway for these ventures to successfully achieve their next financing milestone. This likely reflects that follow-on financing risk is increasing, and must be mitigated in advance.

What does this mean for early- and growth-stage ventures now? To compete, you need to critically evaluate your venture and demonstrate your risk mitigation plans for prospective investors.

Get investor-ready.

Your company needs to be exceptional to be worthy of investors’ time and money. Tailwind’s due diligence and investor readiness process offers a proven method to strengthen your business and gain an unfair advantage to secure capital.