LPs are not happy — and for good reason.

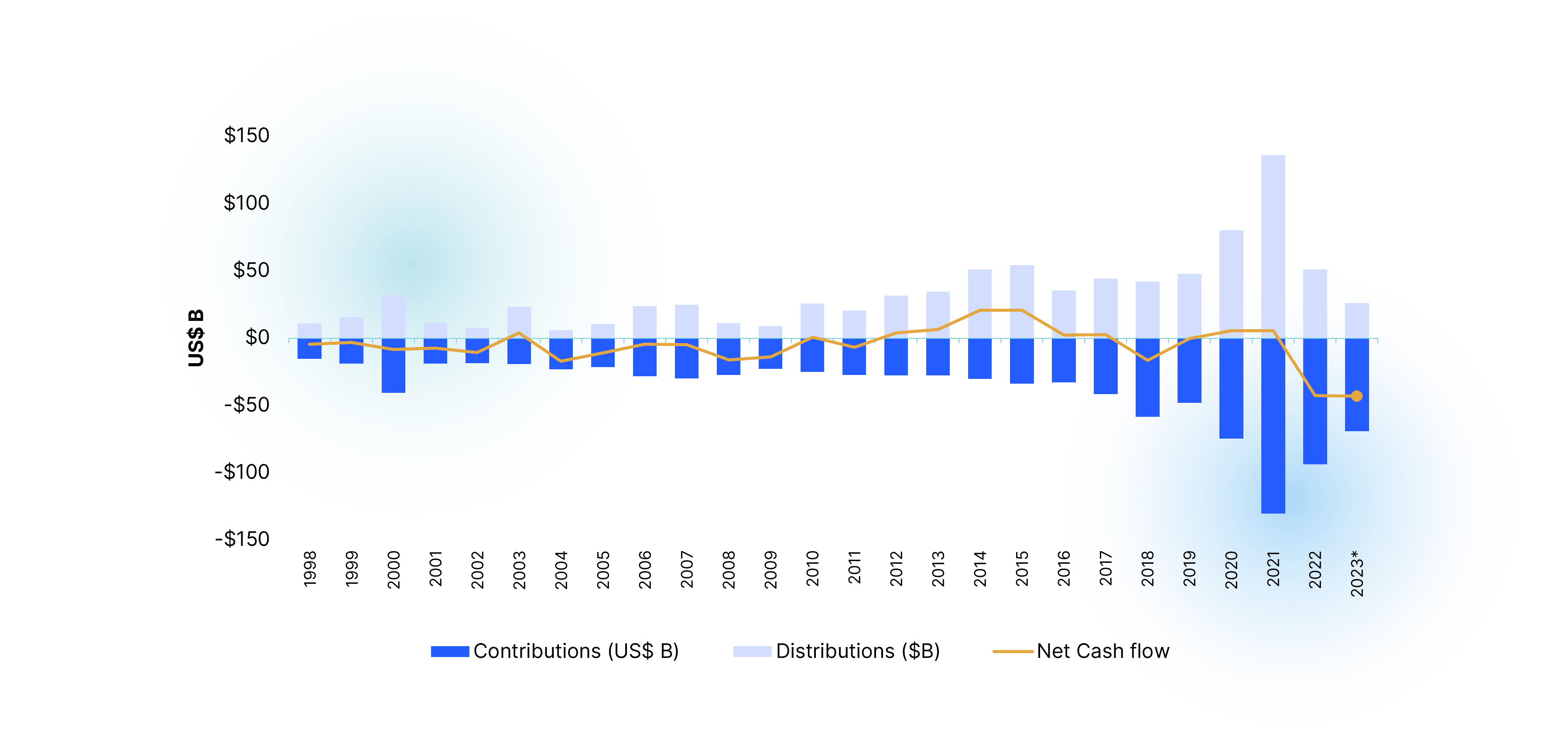

In 2023, net cash flow to LPs was at a deficit of US$43 billion — the largest such annual deficit in US history. And in 2023, the return of capital back to LPs was at its lowest level since the economic crash in 2008 / 2009.

From 2000 to 2023, the cumulative deficit to LPs was US$131 billion. Put another way, over that 24-year span, LPs contributed US$971 billion and only received distributions of US$840 billion.

Who is accountable for this massive erosion of wealth? From the top-down, VCs need to demonstrate greater accountability by being better stewards of their LPs’ money. From the bottom-up, ventures need to demonstrate greater accountability by using capital more prudently.

When capital is not returned to LPs, there is inherently less money and confidence to reinvest into the venture capital asset class. Thus, today’s problems inevitably reverberate into the future.

The big question: What are VCs doing to protect their LPs? What are ventures doing to protect and return dollars to their VCs, and the VCs’ LPs? It’s important that ventures pay it forward – it is incumbent upon today’s ventures to return capital so that tomorrow’s ventures still have access to capital to continue to innovate. We all have a role to play in protecting capital, and it typically starts from the bottom-up — by building better businesses.

Get investor-ready.

Your company needs to be exceptional to be worthy of investors’ time and money. Tailwind’s due diligence and investor readiness process offers a proven method to strengthen your business and gain an unfair advantage to secure capital.