The Risk-Rate Equation: Balancing Uncertainty and Yield.

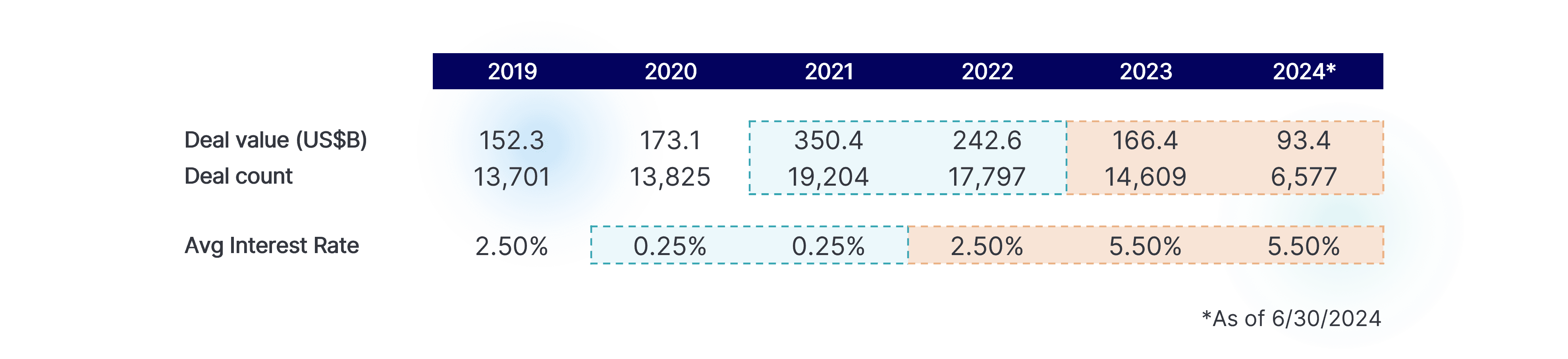

US VC deal value peaked at US$350 billion in 2021 amidst one of the most furious pops in market activity in recent history. This created an environment where risk appetite seemed to be at an all-time high, providing founders with unique opportunities to secure funding.

Investor behaviour is a complex interplay of risk tolerance and economic conditions. When faced with uncertainty, investors often adjust their strategies to minimize potential losses. One of the first things you will see in this blog is “interest rates”, and yes, I know, every one of you just took a massive sigh and your inner voice said, “boring”. The irrefutable truth, however, is interest rates dictate where institutional investors choose to place capital. Risk appetite is a function of an investor’s willingness to bet on uncertainty rather than take the sure thing.

The Interest Rate Influence on Investor Sentiment

Interest rates play a pivotal role in shaping investor sentiment.

When interest rates are low, investors may find it difficult to earn substantial returns from traditional, low-risk investments like bonds. This can lead to a heightened appetite for riskier assets, such as stocks, venture capital, and private equity. The potential for higher returns can outweigh the increased risk, as investors seek to outpace inflation and achieve their financial goals.

Conversely, when interest rates are high, the appeal of low-risk investments becomes more compelling. Investors may be less inclined to take on additional risk if they can earn a satisfactory return from safer options. This can result in a shift away from riskier assets and a preference for more conservative investments.

Other Economic Drivers of Risk Aversion:

- Market volatility: Periods of heightened market volatility can increase investor anxiety and lead to a more risk-averse stance.

- Inflation: High inflation can erode the purchasing power of future returns, prompting investors to seek investments that can outpace inflation.

T

Central banks around the world implemented unprecedented monetary policies, including aggressive interest rate cuts and quantitative easing. The low-interest rate environment created a favourable backdrop for riskier assets, most notably VC and PE.

In 2021 and 2022, US VC deal activity reached the highest levels since the dotcom bubble given the deluge of interest in this asset class, considering the low-interest rate environment and AI hype bubble.

What does this mean for early- and growth-stage ventures now? To compete, you need to critically evaluate your venture and demonstrate your risk mitigation plans for prospective investors.

Conversely, as interest rates began to rise in 2022 and 2023 to combat inflationary pressures from fiscal policy, deal activity has plummeted as investor preference shifts towards safer, lower-risk investments.

In an Investor’s Shoes

Let’s all put ourselves in the fortunate position of having US$1 million to invest in either bonds, or venture capital. (We will also ignore the time value of money for simplicity reasons).

The current US Federal interest rate is 5%. Say we invest our US$1 million in a US government bond with a 5% coupon rate for 10 years, we would earn $50,000 a year, for the 10 years, GUARANTEED, doing no work. That is a down payment on a home… every year.

Alternatively, we could invest US$1 million in a startup that may return 10x (US$10 million) in 5 years. Not bad right? But unlike the bond, this outcome is far from guaranteed. In fact, 99% of startups never make it past the first round of financing.

So, the question is, if you had to choose which strategy to take given current economic conditions, which one would you choose? Do not forget to ask yourself: how would your decision change if the economic conditions were different, and the government bond only returned $10,000 a year?

Conclusion

Risk aversion is a complex psychological phenomenon that is influenced by a variety of economic factors. Understanding how interest rates, market volatility, economic outlook, and inflation impact investor behavior is essential for making informed investment decisions. Since 2022, investors have managed their risk exposure by shifting away from the VC and PE asset classes because of being able to achieve a safer return on investment in economic conditions that simply don’t favour new businesses.

So what can ventures do to mitigate risk? Be proactive. To compete, you need to critically evaluate your venture and demonstrate your risk mitigation plans for prospective investors. De-risking your venture doesn’t only help prospective investors gain conviction and increase chance of investment, but it helps you build a resilient and bulletproof business.

Get investor-ready: identify and mitigate your risks

Your company needs to be exceptional to be worthy of investors’ time and money. Understand how a prospective investor will assess your company: Tailwind's Check6™ process uncovers critical vulnerabilities and identifies the most significant risks that represent barriers to capital.