The opportunity cost of raising money

-- Downloadable resource included --

A capital raise can be a double-edged sword. While it provides funding, the opportunity cost in terms of time, resources, and potential revenue can be substantial. Early-stage companies must carefully weigh the pros and cons before embarking on a fundraising journey themselves, understanding that the true cost often lies beyond the financial aspect.

Let’s explore a short example:

Three partners allocated $100,000 of their own money to develop a business plan to raise $750,000 for their new venture. Eight months later, the founders’ money had been spent, every possible source of funding explored, and no capital raised.

When asked what the same $100,000 would have generated if it had been allocated to sourcing customer leads, they estimated it could have enabled approximately $1 million in revenue.

In this example, was the problem that the founders created an insufficient business case for investment? No – the problem was that the founders’ motivations were misplaced. They devoted too much of their time and resources to a raise, with the incorrect assumption that raising capital would equal success – instead of spending their time building their business and developing their sales pipeline.

A founder's time

Every decision, from whether to work on the product, raise funds, or hire new talent, directly impacts the company's trajectory. Understanding that a startup's lifespan is finite based on these choices is crucial. A founder's ability to prioritize and allocate their time strategically factors into the company's likelihood of success or failure.

If a founder is spending time raising money, naturally, they have less time to focus on sales and other crucial business operations. While a founder may mitigate this by hiring a sales team, a founder is always best suited to be working intimately in the business.

Let’s walk through an illustrative example:

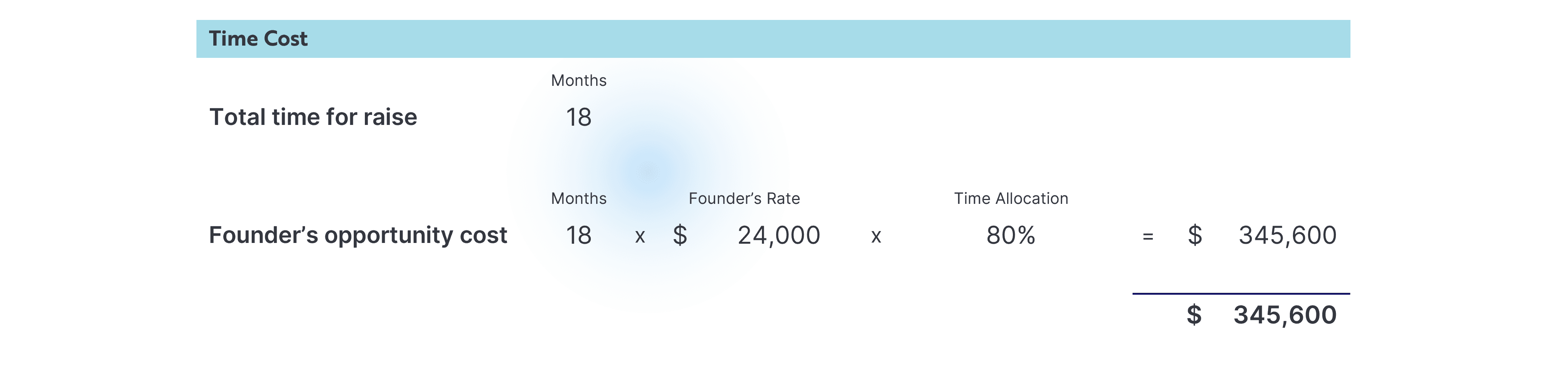

Say that a raise process takes 18 months from start to finish – typical of a Series A round. For the 18 months, a founder allocates 80% of their time, at 60 hours/week, assuming 4 weeks per month, at an hourly rate of $100. This would cost the founder and team $345,600 – expensive.

A founder’s time is too precious and too expensive to misuse. It can be difficult to quantify the value of a founder’s time – and estimating the value at $100 per hour is absolutely on the low side, even for an early-stage startup.

In almost every single case, a business has a greater chance of success if the founder prioritizes working on the business. Building a better business and enabling strong performance will not only greatly increase the chances of a successful capital raise, but it will inherently build towards a business that is self-sustainable, removing the reliance on external capital at all.

Missed opportunities to sell

The impact of sales cycles on early-stage companies is profound.

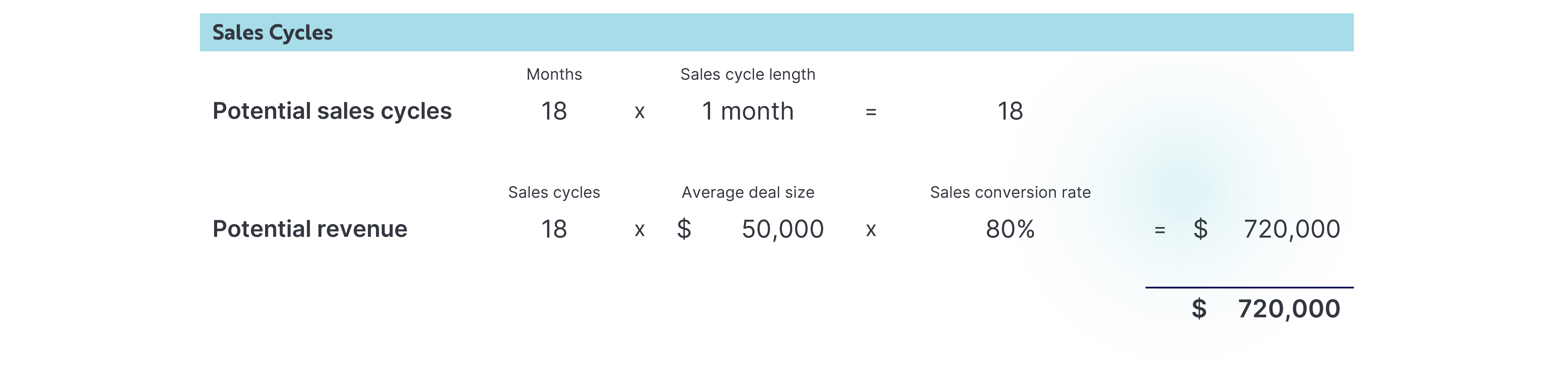

We addressed the impact to a founder’s time when raising capital, so now let’s explore the potential upside that could be generated if the founder’s time was better spent building their sales pipeline.

This example looks at the sales process in a scenario where the founder has proactive support for their capital raise and no longer solely carries the burden for raising money.

In the same 18-month window, we assume that the business can conduct 1 sales cycle per month, equalling 18 sales cycles, at an average deal size of $50,000. With an 80% sales conversion rate, total sales would be approximately $720,000.

Unsung costs of a capital raise

The costs of a capital raise, whether successful or not, often go overlooked.

In the following breakdown, we present some potential costs that can arise throughout a successful Series A capital raise process.

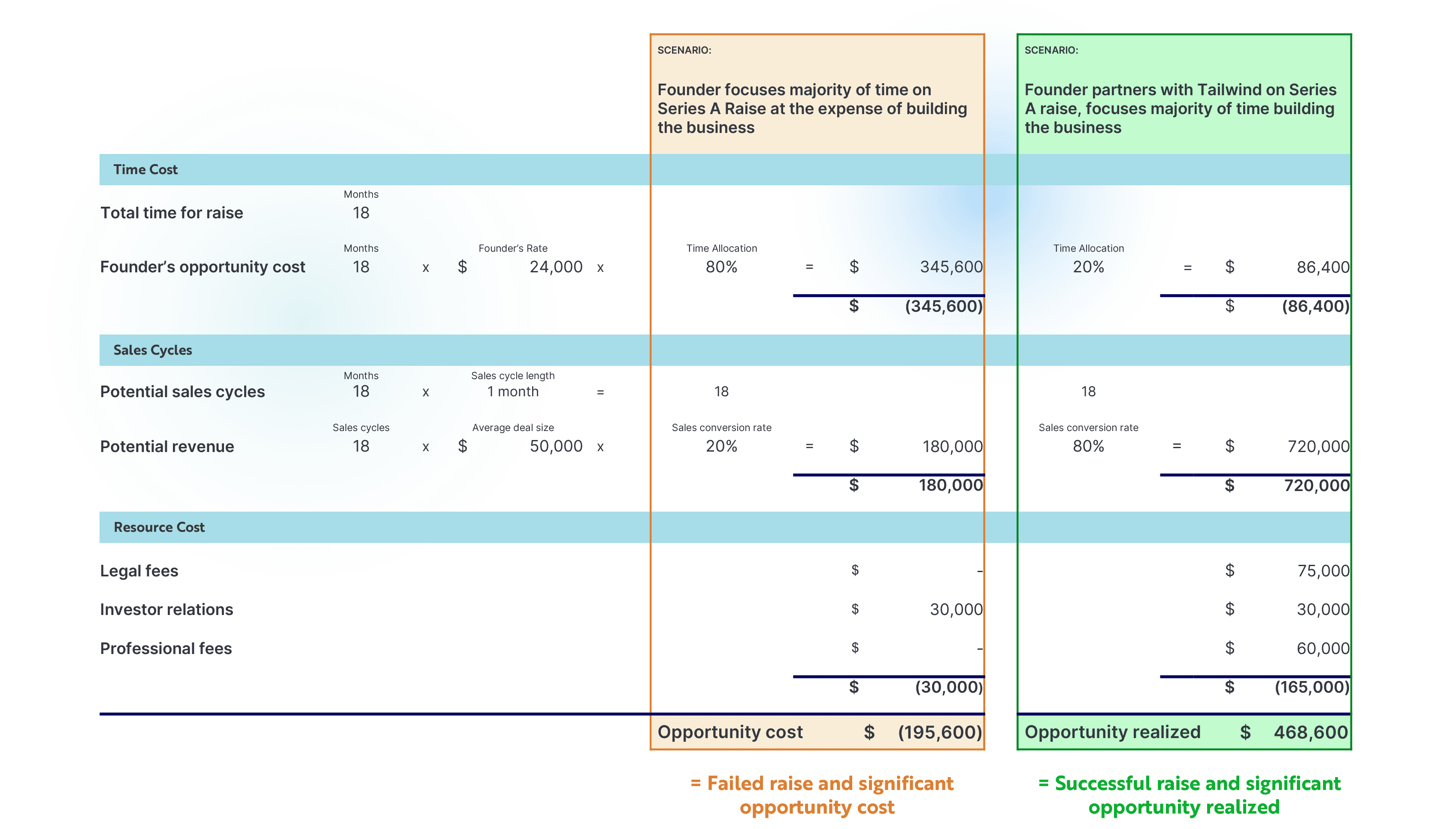

To ensure that the financing terms between company, existing shareholders, and investor is fair, legal, and protects interests of all parties, legal counsel is a necessity. Fees typically cover activities such as due diligence, negotiation of terms, documentation of agreements, and ensuring compliance with securities laws. It is worth remembering that lawyers get paid by the hour, and these processes can take weeks. In this example, we have allocated $75,000.

Investor relations expenses arise when a business is maintaining relationships with current and potential investors. At earlier investment stages, these costs can be relatively low but remain crucial for building and maintaining trust with the investor community. In this example, we have allocated $30,000.

Professional fees are the costs incurred when a company decides to seek specialized expertise and guidance when navigating growth cycles. Early- and growth-stage businesses often opt to work with a third party specifically to avoid taking the founders’ time away from the business. In this example, we have allocated $60,000, a cost that represents a hypothetical fee for a full-suite engagement with Tailwind.

The hard costs of raising capital appear steep – the total in this example is $165,000 – and the instinct for many founders is to look at these costs and think “no, not me, I can do this myself”. But as the final breakdown will show, the opportunity cost of raising capital without support is significant.

Compare opportunity cost based on founder focus

Let’s put these scenarios side by side.

In the first scenario, our founder puts most effort into raising, at the expense of building their business. In the second scenario, our founder secures support from Tailwind, ensuring that most of their time is spent focused on the business.

In the first scenario, we expect some sales will occur which offsets the opportunity cost. But compared to the potential sales in scenario two, the opportunity cost is much higher – the founder would lose the sales opportunity, and the value of their time.

It's the lost opportunities, the delayed growth, and the potential for missed market windows that can be the demise of businesses, rather than the inability to secure external funding.

Download the Opportunity Cost Calculator

Download Tailwind's Opportunity Cost Calculator and run your own scenarios to understand the true cost of raising capital.

Disclaimer: the examples and figures used here and in the downloadable calculator are meant to be illustrative only, but we have used our expertise – based on helping dozens of ventures to raise capital – to establish reasonable proxy for the cost of a capital raise process.