The Perfect Storm: Market Volatility, Policy Uncertainty, and AI Dominance

The Tailwind Ventures Quarterly Market Summary is designed to cut through the noise and bring you the insights we believe are most relevant to the venture ecosystem.

The analysis in this summary is supported by data from Pitchbook, NVCA, CVCA, and other reputable sources – but most importantly, it’s informed by the dynamics we observe every day as we enable ventures to withstand the scrutiny of due diligence and secure capital.

TL;DR

- Venture capital continued to be a challenging landscape to navigate and participate in.

- Macro-economic environment was characterized by significant public market volatility driven by policy and tariff impositions.

- Aggregate deal values appeared robust on the surface, but VC market performance masked a concerning over-reliance on AI investments and a single major exit.

- Q1 showed a persistent and troubling cycle, where limited exit opportunities and heightened market uncertainty stifles fundraising and sector diversification.

The Perfect Storm: Market Volatility and Policy Uncertainty

Q1 2025 unfolded like a financial thriller, with markets swinging dramatically in response to tariff implementations by global leaders. The US administration’s approach to trade policy created an environment where a single press conference or social media post triggered significant market movement, reminiscent of the volatility experience during the pandemic.

Actions like these tend to have a ripple effect, manifested as investors became increasingly cautious about deploying capital in an already high-risk asset class. The result was a fundraising environment that faces its most significant challenges in over a decade.

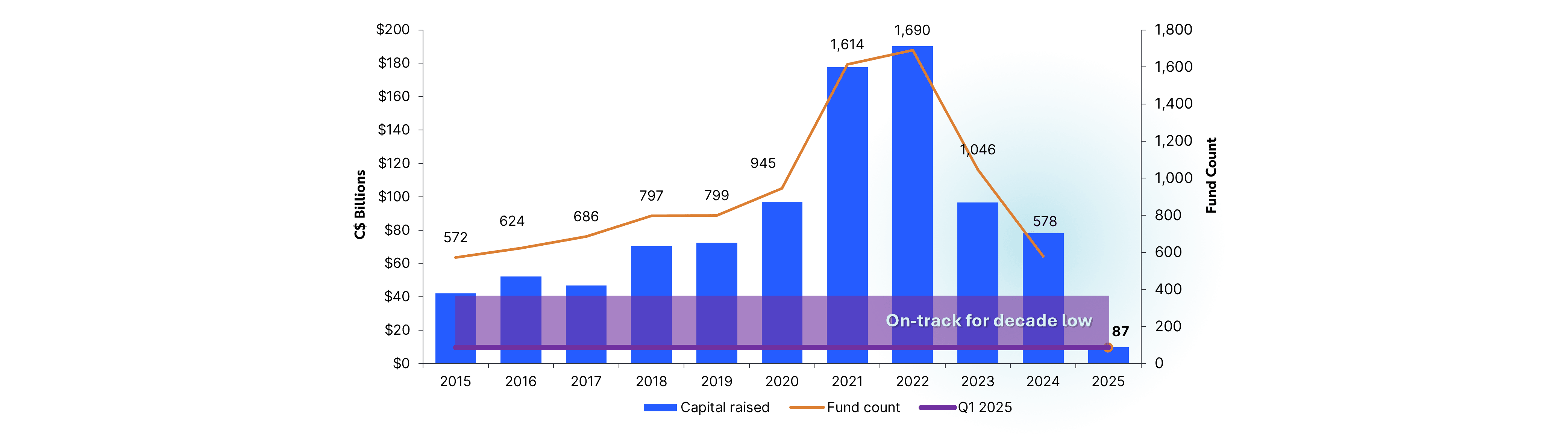

VC Fundraising Landscape: A Decade Low

- The fundraising statistics at the GP level for Q1 2025 paint a stark picture of LP investor sentiment:

- $10 billion raised across 87 VC funds - setting the pace for the lowest annual fundraising total in a decade

- Over 50% of capital within 2-5 year investment periods - the highest concentration in ten years, indicating limited fresh capital deployment

- Median time between fundraises exceeded three years - a concerning milestone suggesting fund managers are struggling to secure follow-on capital

- Dry powder declined from $324.5 billion to $289.7 billion as institutional investors pivoted away from venture capital

U.S. VC Fundraising Activity

The fundraising drought stems from capital allocations, particularly institutional investors, favouring more predictable asset classes given the extended exit timelines. The 2021 – 2022 venture surge created what could be described as a sector-wide hangover, with investors adopting a “never again” mentality toward the aggressive deployment strategies that characterized the peak funding period.

The Exit Conundrum: When Success Takes a Decade

VC’s fundamental promise rests on successful exits – the transformative events that validate years of risk-taking and capital deployment. However, the pathway to exit has become more challenging, with average timelines from initial funding to liquidity event now stretching to 12 years or more.

An extended timeline creates a cascading effect throughout VC. The 2021 – 2022 funding peak produced a generation of companies now caught in limbo between late-stage funding rounds and viable exit opportunities, with the aforementioned market conditions providing little momentum for resolution.

The CoreWeave Exception: Q1’s exit landscape was dominated by a single success story – Coreweave’s IPO, which represented 40% of the quarter’s total exit value. While market conditions initially dampened investor confidence, CoreWeave’s subsequent 270% post-IPO performance (as of June 10th) demonstrates the potential for exceptional returns in the right circumstances. This success story highlights the critical role of AI-focused companies in current market.

AI Investment: The Double-Edged Sword

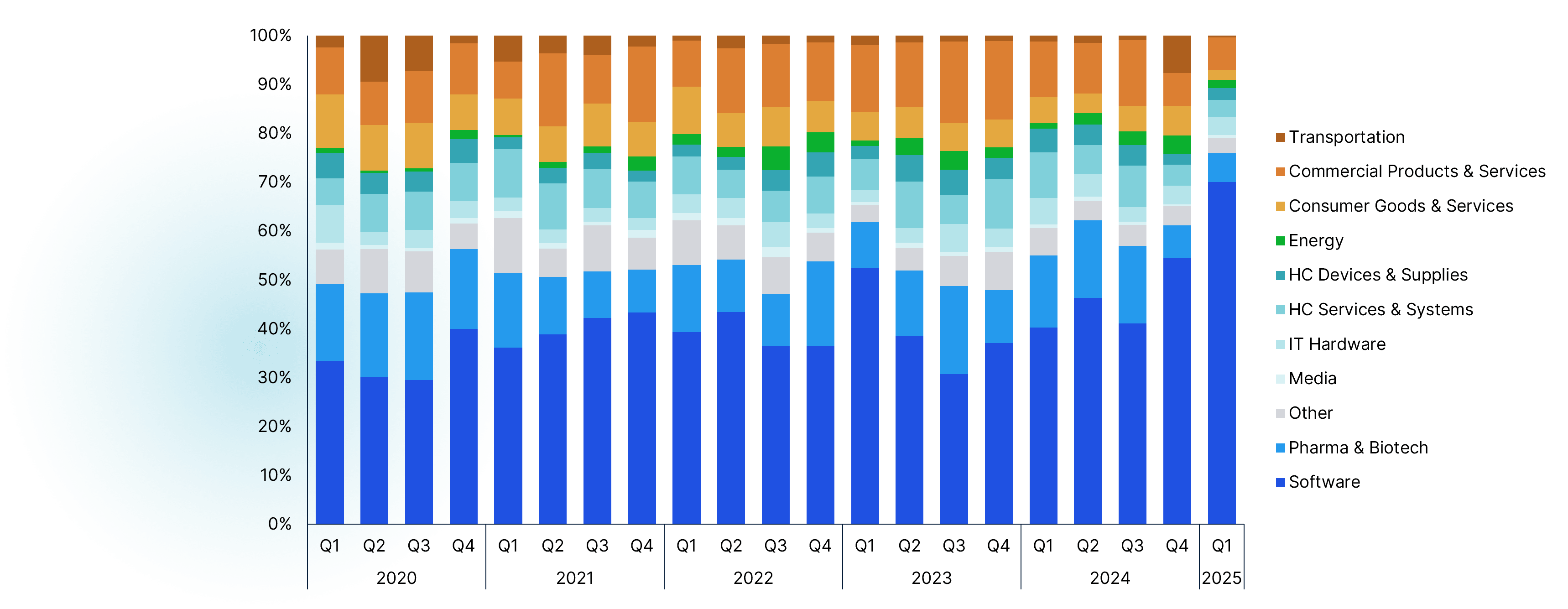

AI investment has emerged as both the sector’s savoir and vulnerability. Under Pitchbook sector classifications, AI companies fall within the broader “software” category, but the impact extends far beyond conventional software metrics.

The Numbers Tell the Story:

- AI captured 71.1% of VC deal value in Q1 2025, compared to 40.3% in Q1 2024.

- Concentration helped drive overall deal values approximately 19% higher than the previous quarter – the strongest performance since Q1 2022.

U.S. VC Deals by Sector

This apparent strength masks underlying concerns. The heavy concentration in AI reflects a flight-to-quality mentality among investors seeking perceived safety in a turbulent market. Corporations, facing cost pressures from tariff implementations, are aggressively pursuing AI solutions to improve operational efficiency, creating substantial demand for AI-focused startups.

While this trend has propped up overall sector metrics, it has also created dangerous concentration risk. The venture ecosystem's health now depends heavily on continued AI investment momentum, making it vulnerable to any shifts in corporate AI adoption strategies or regulatory changes affecting the sector.

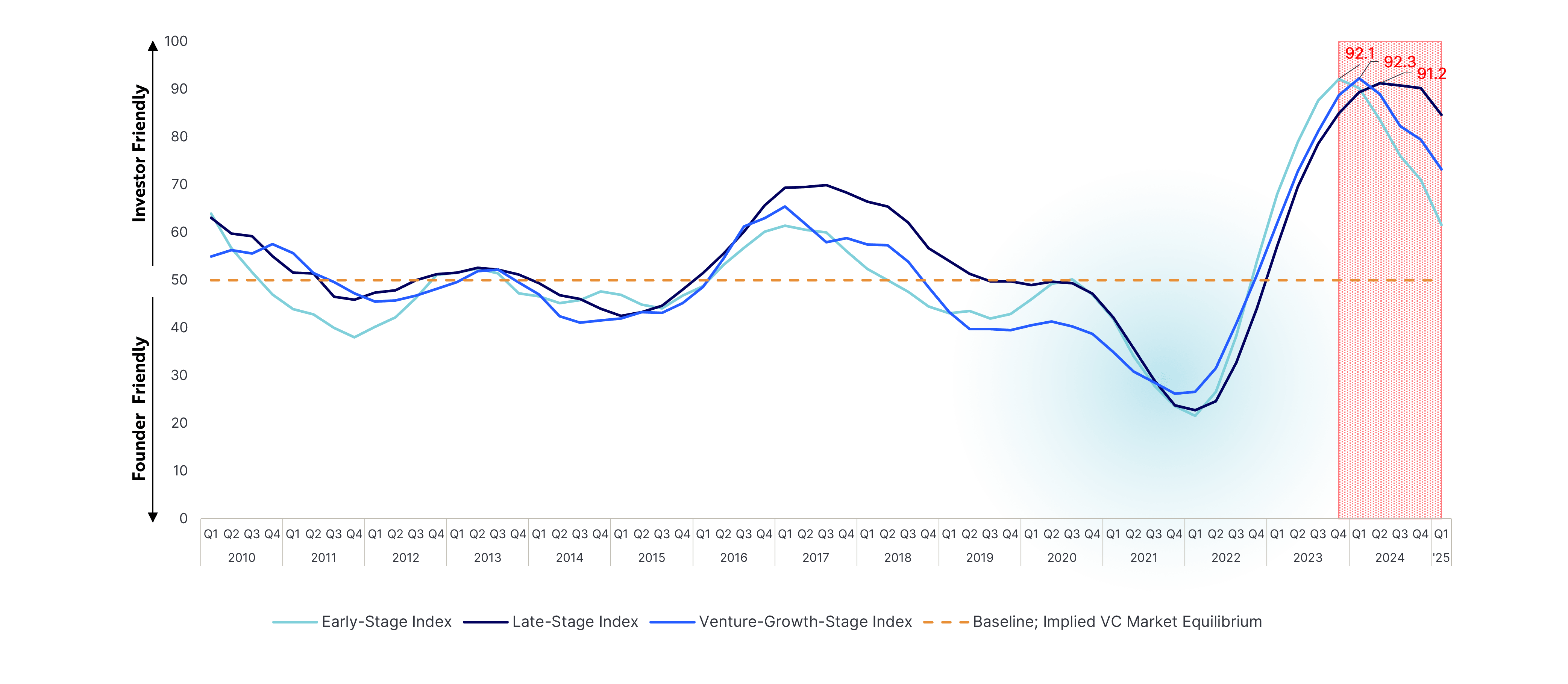

U.S. VC Dealmaking Indicator1

Over the trailing 5 quarters, PitchBook's VC dealmaking indicator tracked all-time highs across all venture deal stages, indicating that this is the most asymmetrical VC market on record, in favour of investors.

Connecting the Dots

The Q1 2025 venture landscape reveals a concerning interconnected cycle that threatens long-term sector health:

- Extended Exit Timelines limit returns to early investors, reducing their appetite for new commitments.

- Concentrated AI Investment creates the illusion of sector health while masking underlying diversification problems.

- Policy Uncertainty and Tariffs drive risk-averse behavior among institutional investors.

- Limited Fundraising Success constrains capital availability for early-stage companies.

- Reduced Portfolio Diversification increases vulnerability to sector-specific downturns.

This cycle becomes self-reinforcing as each element amplifies the others, creating a challenging environment for sustainable venture ecosystem growth

Raising capital is tough. You can be ready.

Market conditions demand that companies seeking capital must level up the quality of their opportunity – which means building a stronger, more resilient business, and diligently prepare to compete for investment.

Tailwind Ventures empowers early- and growth-stage companies to navigate the increasingly competitive landscape, withstand the scrutiny of due diligence, and secure capital. Our diligent preparedness process improves the risk-reward relationship for ventures and investors, increasing the likelihood of investor conviction. Tailwind Ventures has raised over $370 million for clients since 2022.

Data notes:

Data appearing in this summary use datasets from Pitchbook-NVCA Venture Monitor Q1 2025 and CVCA Canadian Venture Capital Market Overview Q1 2025.

1: PitchBook’s VC Dealmaking Indicator metric is outlined as follows:

- What it measures: it assesses the favourability of the venture fundraising / investing market for ventures / investors, across each stage of the market (early-stage, growth-stage, and late-stage),

- How to interpret the assessment: a score of 50 implies market equilibrium, in which venture dealmaking power dynamics are balanced between ventures and investors. The higher the score above 50, the higher the indication that it is an investor-friendly market. The lower the score below 50, the higher the indication that it is a venture-friendly market.

- The methodology: the Dealmaking Indicator reflects key deal terms and attributes captured across three categories of PitchBook data:

- Market liquidity measures (capital demand-supply ratio, startup funding rate)

- Cap table information (cumulative dividends, liquidation participation, percentage acquired)

- Momentum metrics (years between VC rounds, valuation change)